Highlight - RWA management

Real-world asset (RWA) tokenization is transforming institutional finance, with major financial institutions like BlackRock and ABN AMRO leading the way in utilizing innovative, blockchain-based assets. These assets involve U.S. treasuries, real estate, and private credit. This breakthrough is creating new opportunities, but managing and optimizing these portfolios across multiple chains and decentralized exchanges (DEXes) remains a significant challenge.

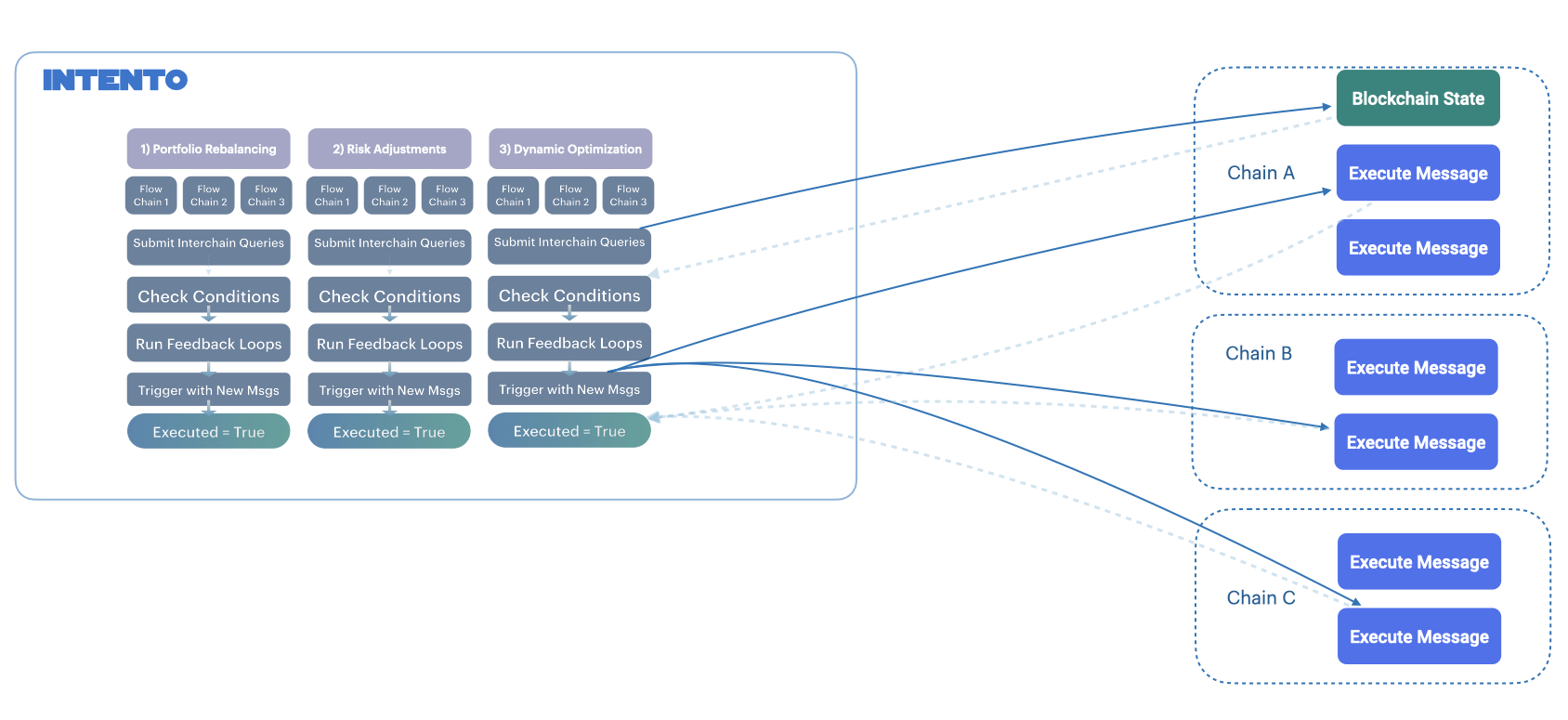

Intento enables institutional investors to orchestrate blockchain interactions such as portfolio rebalancing, liquidity optimization, and risk management across chains and trading venues. By leveraging intent-based execution and cross-chain interoperability via Interchain Accounts, Interchain Queries, and conditional execution, Intento ensures efficient allocation of RWAs without reliance on custodial intermediaries.

Key Approaches to Portfolio Management

1 - Automated Portfolio Rebalancing

Challenge: Institutions need to rebalance their RWA portfolios efficiently across multiple blockchains without manual intervention.

Intento’s Solution:

- Dynamic inputs for decision-making: Portfolio rebalancing decisions are based on dynamic inputs such as balance updates, price information, or other relevant blockchain data, which guide the flows and the next actions.

- Rebalancing execution: ICAs enable automatic swaps and reallocations across chains and DEXes based on the latest data.

- Threshold-based triggers: When RWAs exceed predefined thresholds, the system triggers rebalancing into stablecoins or other yield-bearing assets.

Outcome: Continuous portfolio optimization with minimal manual oversight, adapting to real-time data.

2 - Comparisons & Risk Adjustments

Challenge: Institutions need to dynamically adjust holdings based on yield spreads, market conditions, and liquidity factors.

Intento’s Solution:

- Yield Comparison: If tokenized treasuries on Chain A yield 0.5% more than on Chain B, reallocate assets accordingly.

- Liquidity Check: Before executing swaps, verify liquidity depth across multiple DEXes to avoid high slippage.

- Volatility-Based Adjustments: If an asset’s volatility exceeds a set threshold, hedge with stablecoins or derivatives.

Outcome: Smart, data-driven execution that enhances risk-adjusted returns and efficiency.

3 - Dynamic Optimization

Challenge: Institutions require real-time insights on interest rates, TVL, collateral ratios, and liquidity conditions.

Intento’s Solution:

- Real-time Yield Optimization: ICQs fetch the best lending rates across multiple chains and adjust allocations dynamically.

- Collateral Management: Monitor LTV ratios and reallocate collateral to prevent liquidation risks.

- Liquidity Monitoring: If a protocol experiences declining liquidity, withdraw funds and reallocate to higher-volume markets.

Outcome: A continuously self-optimizing portfolio that adapts to changing market conditions in real time.

Case Study: Ondo Finance

Ondo Finance is a leading RWA protocol offering tokenized U.S. Treasuries (OUSG). Institutions holding OUSG can use Intento to enhance their portfolio management:

1. Cross-Chain Yield Optimization

- ICQ: Query OUSG yields on several chains.

- Condition: If a chain offers >0.5% higher APY, reallocate assets.

- ICA: Execute cross-chain transfers to the optimal yield source.

🔹 Outcome: Yield maximization across multiple networks.

2. Liquidity-Aware Rebalancing Across DEXes

- ICQ: Query liquidity depth and swap fees.

- Condition: Select the optimal route.

- ICA: Execute swaps on the most efficient venue.

🔹 Outcome: Cost-efficient execution with minimal slippage.

3. Dynamic Hedging Against Rate Fluctuations

- ICQ: Monitor macro indicators (e.g., Fed interest rate changes) via query to a chain with such an oracle.

- Condition: If rates drop by >0.25%, shift OUSG holdings into stablecoin yield strategies.

- ICA: Automate asset reallocation to protect returns.

🔹 Outcome: Institutions stay ahead of macro risks with dynamic hedging.

Conclusion

By integrating with Intento, institutions achieve orchestrated, yield-optimized, and risk-managed exposure to tokenized RWAs. Intento transforms passive RWA holdings into actively managed, cross-chain portfolios, ensuring optimal returns while mitigating risks.

Key Benefits:

Automated portfolio rebalancing via ICAs

Real-time data-driven execution with ICQs

Liquidity-aware routing across DEXes

Dynamic risk management and hedging

Institutions can now manage on-chain portfolios with the sophistication of traditional finance, but with the flexibility of decentralized execution.